2023 Maximum Broker Commissions for Medicare Advantage & Medicare Part D

We’ve got fantastic news for agents planning on selling 2023 Medicare products. The maximum broker commissions for Medicare Advantage and Medicare Part D plans have increased for the eighth year in a row!

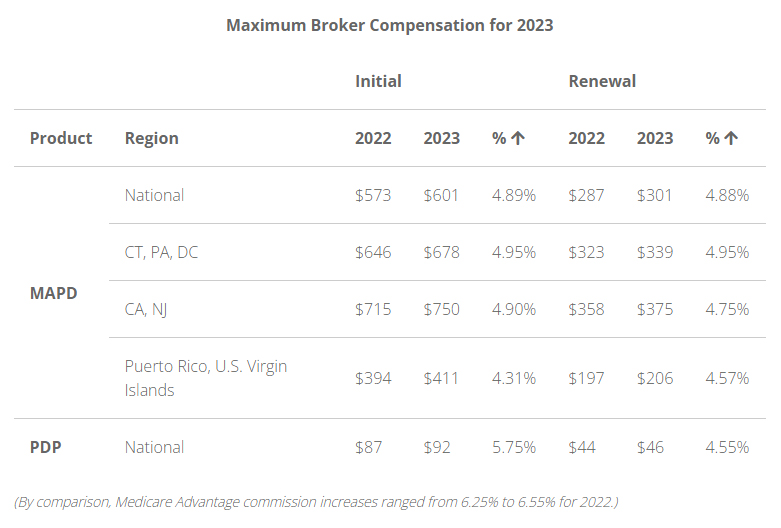

Here’s a chart comparing the Medicare maximum broker commissions for 2022 vs. 2023.

Note: Insurance providers are not required to pay the maximum Medicare commission rate. We’ll let you know when insurance companies release their 2023 filings.

Medicare Part D Maximum Broker Commissions

Initial commissions increased from $87/member/year to $92/member/year, a 5.75% increase YOY.

Renewal commissions increased from $44/member/year to $46/member/year, a 4.55% increase YOY.

Medicare Advantage Maximum Broker Commissions

These numbers are broken out by state/region.

For CA and NJ, initial MA commissions increased from $715/member/year to $750/member/year, a 4.9% increase YOY. Renewal commissions increased from $358/member/year to $375/member/year, a 4.75% increase.

For CT, PA and DC, initial MA commissions increased from $646/member/year to $678/member/year, a 4.95% increase YOY. Renewal commissions increased from $323/member/year to $339/member/year, a 4.95% increase.

For Puerto Rico and the U.S. Virgin Islands, initial MA commissions increased from $394/member/year to $411/member/year, a 4.31% increase YOY. Renewal commissions increased from $197/member/year to $206/member/year, a 4.57% increase.

In all other states, initial MA commissions increased from $573/member/year to $601/member/year, a 4.89% increase YOY. Renewal commissions increased from $287/member/year to $301/member/year, a 4.88% increase.

If you are not already selling Medicare Advantage Plans and Medicare Part D Plans with Eldercare, let us explain the benefits of doing that business with us.

Call 800-777-9322 or Email info@eisgroup.net to learn more.